The New South Wales government has recently introduced a new scheme which revolutionises stamp duty for first home buyers with the aim of assisting them enter into the housing market. This comes as welcome news to first home buyers who have struggled to get their foot on the ladder due to record rises in house prices.

First Home Buyer Choice

This scheme will give first home buyers the choice to pay an annual property tax based on the unimproved value of the property or upfront ad valorem stamp duty.

The idea behind the initiative is that it will decrease the costs to be paid on settlement, meaning that first home buyers have to save less as their upfront costs are reduced.

The annual property tax payments are based on the land value of the property where as stamp duty is based on the current market value. Tax rates for the property tax are as follows:

- $400 plus 0.3% of land value for owner occupied properties.

- $1500 plus 1.1% of land value for investment properties.

The tax rates will be indexed each year, so that the rate rises in line with average incomes.

Assessments will be issued for each financial year. If a property is owned for less than a full financial year, an adjustment will be made based on the period of days the property is owned.

What does this mean in real terms?

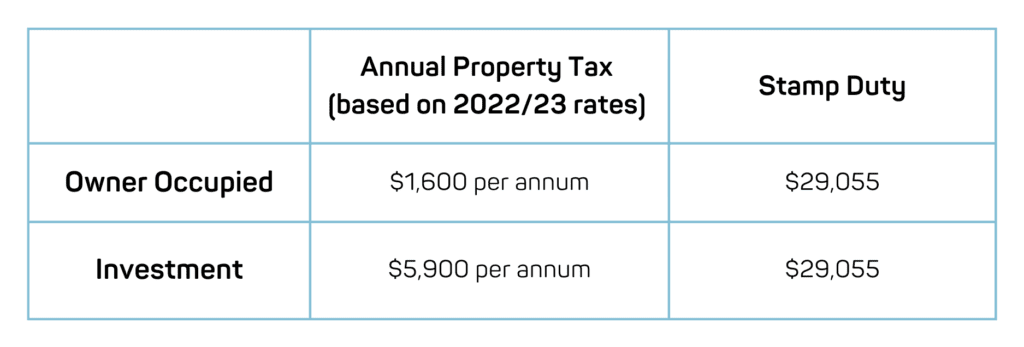

Say the property you were looking to purchase had an unimproved value of $400,000.00 but was being sold for $750,000.00. The duty or annual property tax payable would be as follows:

After 16 January 2023, when the scheme commences, First Home Buyers who opt into the scheme will not be required to pay stamp duty to complete their transaction.

Eligible first home buyers who enter into contracts between the passage of enacting legislation and 15 January 2023, can opt into the property tax but will still need to pay applicable stamp duty. They can then apply for a stamp duty refund after 16 January 2023.

First Home Buyer Grants and concessions will continue to be available. More information about those schemes can be found here.

However, when these concessions are limited to properties worth $800,000.00 or less, many first home buyers have not seen the benefits of these schemes, considering median home prices in the Newcastle and Lake Macquarie area are now in the region of $900,000.00. The new scheme will therefore help a broader range of first home buyers.

What is the eligibility criteria?

To be eligible, a first home buyer must:

- Be an individual, not a company or trust.

- Be over the age 18.

- Be purchasing a property for $1.5m or less.

- Move into the property within 12 months of purchase and for a continuous period of six months.

- Sign your contract for sale after the scheme commencement date on 16 January 2022.

- Be an Australian Citizen or permanent resident (or at least one of the owners must be)

- The owner and their spouse must not have previously =

- Owned or co-owned residential property is Australia.

- Received a First Home Buyer Grant of concession previously.

If you are looking to place an offer on a property, Contact Us on (02) 4943 3988 to make an appointment with one of our experienced property lawyers. We have years of experience helping people with their conveyancing needs throughout the Newcastle, Lake Macquarie and Hunter region.

This blog was written by Senior Associate,

Liz McIntyre

Liz practises in the areas of Family Law, Wills & Estate Planning,

Deceased Estates, Wills disputes and Conveyancing